NVIDIA has backed AI inference startup Baseten with a $150 million investment as part of a larger funding round that has pushed the company’s valuation to $5 billion, more than twice its previous level, according to a media report.

The funding round raised $300 million in total and was led by venture firms Institutional Venture Partners and CapitalG, the independent growth fund linked to Alphabet. NVIDIA participated in the round, underscoring its growing focus on startups that specialise in running AI models efficiently rather than training them from scratch.

The deal reflects a broader shift across the AI industry, where attention is moving away from building ever-larger models and toward deploying those models at scale in real-world applications. It also marks another instance of NVIDIA investing in a company that is already a customer of its AI chips.

Inference Gains Momentum as AI Moves From Training to Deployment

Founded in 2019, San Francisco–based Baseten provides infrastructure that helps companies deploy and manage large language models in production. Its customers include AI coding tool Cursor and productivity platform Notion. With the latest funding, Baseten has now raised a total of $585 million. Co-founder and chief executive Tuhin Srivastava has said the company aims to build an “AWS for inference.”

For NVIDIA, the investment aligns with a strategic direction repeatedly highlighted by chief executive Jensen Huang. He has argued that inference — the process of running trained models — will eventually represent a much larger market than training itself. As companies move beyond AI pilots and begin rolling out features at scale, demand for dependable and cost-efficient inference infrastructure is growing rapidly.

Baseten’s platform is designed to run on NVIDIA’s most advanced GPUs, including the H100 and upcoming B200 chips. By optimising inference workloads for this hardware, Baseten strengthens NVIDIA’s broader ecosystem and helps reinforce its position as the preferred supplier of AI infrastructure.

CapitalG’s involvement adds an interesting layer, given Alphabet’s own investments in AI models and infrastructure. Even so, the deal highlights how central inference has become, even among firms that compete in other parts of the AI stack.

At a $5 billion valuation, Baseten now sits among a small group of AI infrastructure startups commanding premium prices. Investors believe companies focused on inference are well placed to benefit as AI adoption expands beyond large technology firms into areas such as productivity software, finance and creative tools.

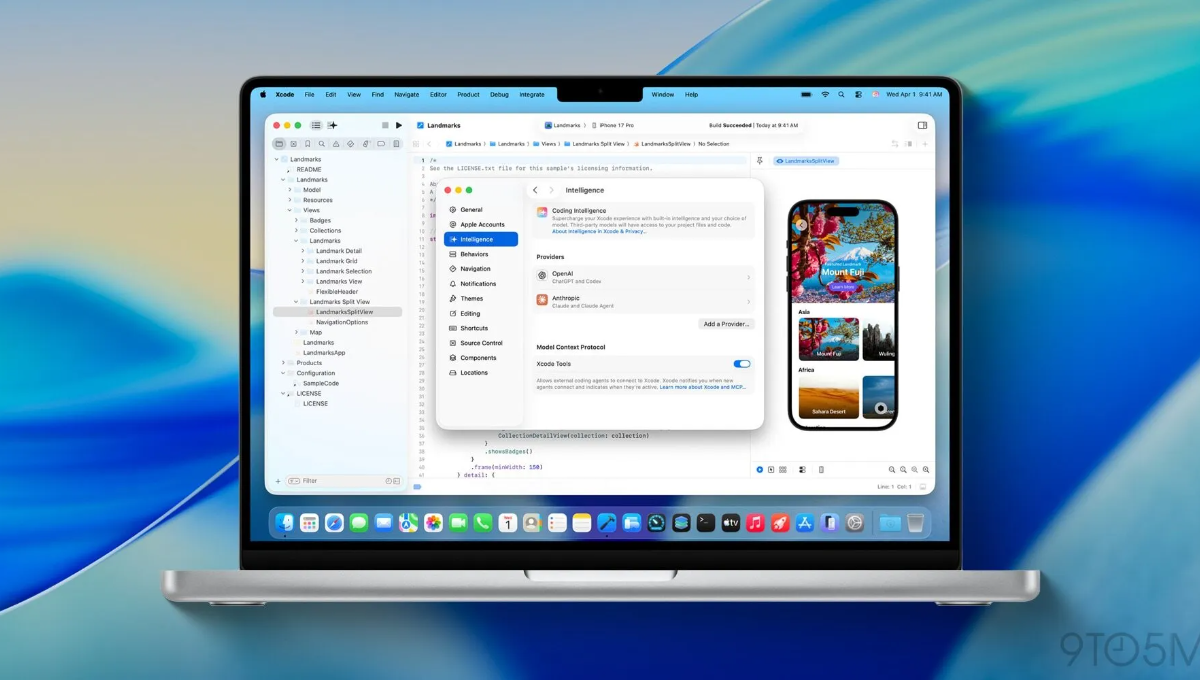

Baseten has also attracted developers through Truss, its open-source framework aimed at simplifying model deployment. The tool allows teams to package models, handle dependencies and scale inference workloads more easily, a capability that is becoming increasingly important as AI features are built directly into everyday products.

Also Read: NVIDIA’s 260,000 GPUs to Power South Korea’s AI Ambitions