Nvidia’s Record Q3 Performance and Surging AI Demand

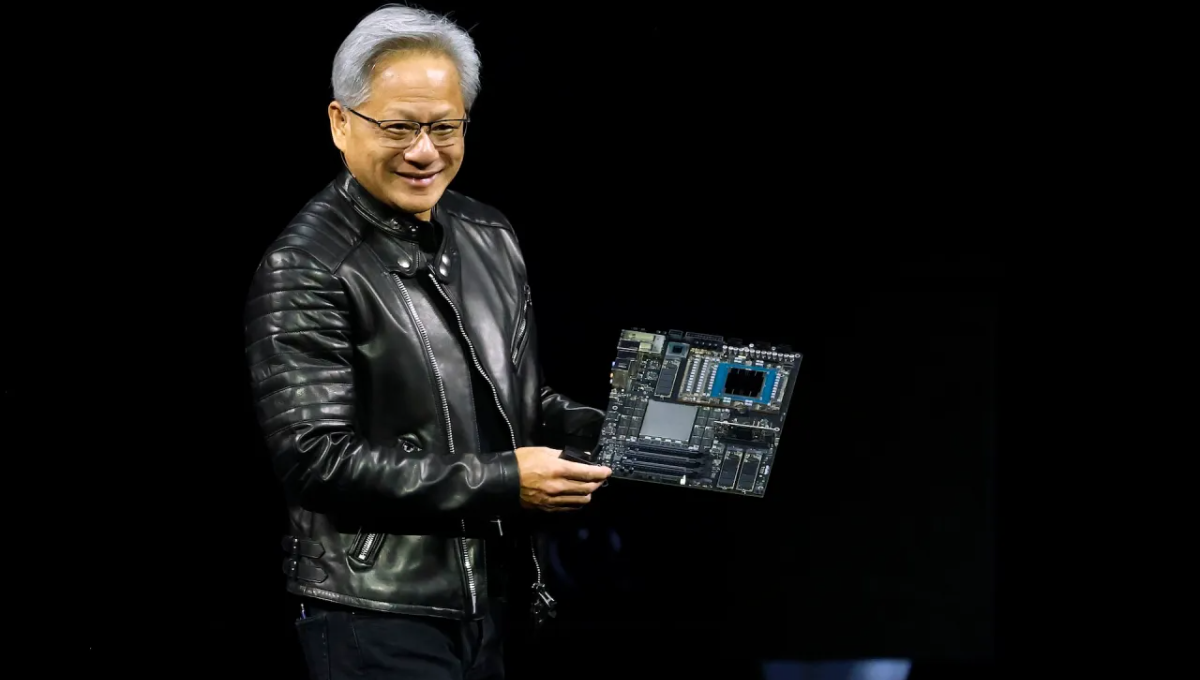

Nvidia CEO Jensen Huang struck an optimistic tone during the company’s third-quarter earnings call—and the results themselves offer support for his confidence.

The company reported Q3 revenue of $57 billion, a 62% jump from the same period last year. GAAP net income reached $32 billion, up 65% year-over-year. Both numbers exceeded Wall Street expectations.

Nvidia’s growth continues to be driven overwhelmingly by its data center division, which brought in a record $51.2 billion—25% higher than the previous quarter and 66% above last year. The remaining $5.8 billion in revenue came from gaming at $4.2 billion, followed by professional visualization and automotive sales.

CFO Colette Kress told shareholders that demand for the company’s data center products is being propelled by rapid advances in computing power, large AI models, and agent-based applications. She also highlighted that Nvidia announced AI factory and infrastructure projects this quarter totaling roughly 5 million GPUs.

Kress said that this demand spans cloud providers, national governments, enterprise customers, modern builders, and major supercomputing facilities, including several large-scale deployment projects.

The company’s Blackwell Ultra GPU, unveiled in March and available in multiple configurations, has become a standout performer. Earlier Blackwell architecture chips also continued to see strong momentum.

Huang emphasized that demand for Blackwell GPUs is overwhelming, describing their performance in the market as “off the charts.”

He added that cloud GPU inventory has already sold out, with both training and inference workloads accelerating rapidly. According to Huang, the AI ecosystem is expanding across industries, startups, and countries, creating what he called a “virtuous cycle” of AI adoption.

Setbacks in China and Outlook for Future Growth

Kress did acknowledge one major setback: shipments of the H20 data center GPU reached 50 million, a weaker result tied to restrictions preventing the company from selling certain advanced chips in China.

She explained that anticipated large orders from China did not materialize due to geopolitical limitations and rising local competition. Despite this, she said Nvidia remains committed to working with both U.S. and Chinese officials and supporting America’s ability to compete globally.

Looking ahead, Nvidia expects even stronger results, forecasting $65 billion in revenue for the fourth quarter. The upbeat outlook sent shares climbing more than 4% in after-hours trading.

Huang dismissed concerns about an AI bubble, saying that from the company’s perspective, what’s happening instead is sustained, accelerating growth.

Also Read:

Larry Summers resigns from OpenAI board following Epstein file disclosures